Home Loan Resources

How to Buy Your First Home with Less Than 20% Deposit in 2025

1st October 2025

Saving a 20% deposit for a home can be difficult - especially with rising property prices, living costs and tighter rental conditions. But the good news is that in 2025, first-home buyers in Australia still have several pathways to buy with a smaller deposit.

Here’s how you can get into your ... read more

Avoiding or Reducing LMI in 2025: A Guide for First-Time and Low-Deposit Buyers

1st September 2025

In today’s lending environment, understanding Lender’s Mortgage Insurance (LMI) is essential for Australian homebuyers, especially those entering the market with smaller deposits. As lending policies and housing prices shift, knowing when LMI applies, how to manage it, and what factors i ... read more

Refinancing Strategies: When and How to Switch Your Home Loan in 2025

28th July 2025

With interest rates shifting and new loan products constantly entering the market, 2025 is a great time to review your home loan. Refinancing could help you save money, access better features, or consolidate debts, but it is important to know when it makes sense and how to do it the right way. ... read more

Rural Lifestyle Homes

27th June 2025

Looking for Space to Breathe? Here's What You Need to Know About Financing Larger Blocks

Many Australians dream of owning a few acres, somewhere the kids can play and explore, where you might keep a horse or two, or simply enjoy the privacy and peace of a larger block of land.

However, financing t ... read more

Using Parental Support Strategically: Family Pledge Loans and Guarantees

29th May 2025

For many Australians, saving for a home deposit remains one of the most challenging steps in purchasing a property. With house prices continuing to rise, more families are exploring ways to support the next generation in overcoming this financial hurdle. One increasingly popular solution is the fami ... read more

Getting pre-approval for your home loan

28th April 2025

The Australian property market in 2025 continues to face significant challenges, driven primarily by a shortage of available housing, strong migration, and affordability constraints. These pressures have intensified buyer competition, particularly in metropolitan and regional growth areas. In this c ... read more

First Home Buyer Grants and Assistance Programs in 2025

24th February 2025

In 2025, first-time homebuyers in Australia have access to a variety of grants and assistance programs designed to assist with home ownership. These initiatives are available at both federal and state levels, each with specific eligibility criteria and application processes.

Federal Programs: ... read more

Do You Have to Pay Clawback Fees? The Facts for Borrowers

21st November 2024

When navigating the home loan process, understanding the nuances of fees and commissions is essential. One question that often arises is about clawback fees. Are these something borrowers need to worry about? Let’s break it down.

What Is a Clawback?

When a mortgage broker assists you in secu ... read more

Why Mortgage Brokers Originate Nearly 75% of Home Loans in Australia

24th September 2024

As of September 2024, mortgage brokers in Australia continue to play a pivotal role in the home loan market, originating nearly 75% of all home loans. This significant market share underscores the essential services brokers provide to consumers navigating the complex landscape of home financing. Und ... read more

What's Up (or Down) with Interest Rates?

2nd September 2024

We’re living in some pretty unpredictable times, aren’t we? Remember when the Reserve Bank assured us that interest rates would stay low for another four years? That prediction didn’t exactly pan out as expected. As the global economy emerged from its COVID-induced slowdown, things ... read more

Strategies for Managing Your Mortgage During Economic Uncertainty

22nd July 2024

With rising interest rates, inflation, and increasing cost of living pressures, managing mortgage payments has become a critical concern for many Australian homeowners. At Regional Finance Solutions, we are dedicated to helping you navigate these challenging times with informed strategies and expert ... read more

The Benefits of Using a Mortgage Broker vs. Going Directly to a Bank

27th May 2024

When it comes to securing a home loan, Australians are often faced with a critical decision: should they use a mortgage broker or go directly to a bank? This choice can significantly impact the loan process, interest rates, and overall satisfaction. In this blog post, we will compare the advantages ... read more

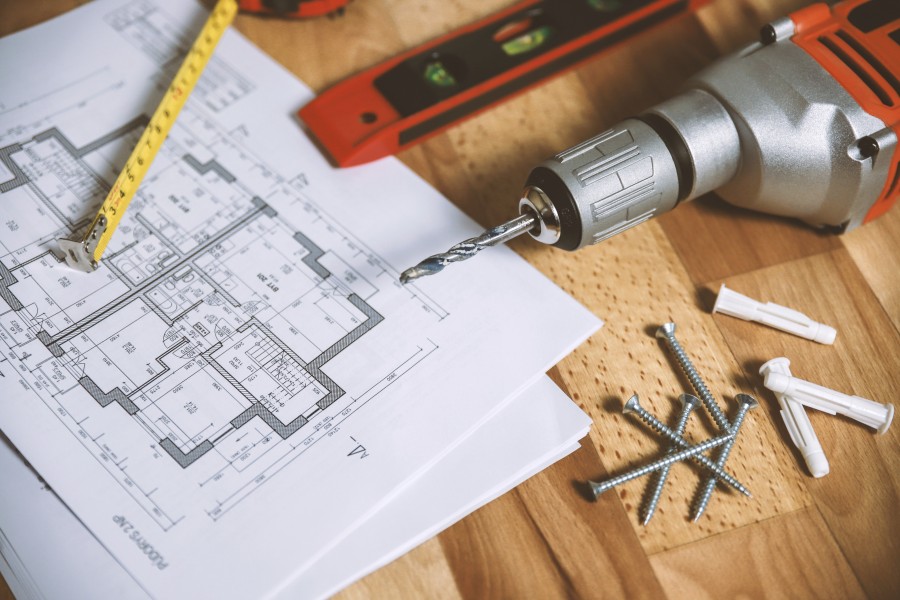

How to make your construction home loan painless

6th February 2024

Building your dream home can be a complex journey. From managing tradespeople to selecting finishes, coordinating with builders, and managing the nuances of finance, it’s a path laden with potential stress. At Regional Finance Solutions, we understand these challenges and are here to ease one of t ... read more

Refinancing Your Mortgage for the New Year: A Smart Financial Resolution

4th January 2024

Happy New Year, everyone! The start of a new year is the perfect time for resolutions – whether it’s finally hitting the gym (and not just for the free air conditioning in summer) or cutting down on the 'occasional' treat (we’re looking at you, chocolate!). But let’s talk about a resolution ... read more

First Home for the Holidays: A Guide for First-Time Buyers in Australia

27th November 2023

The holiday season in Australia isn’t just about barbies, beach days, and Boxing Day cricket; it's also a fantastic time for first-time homebuyers to start their journey towards home ownership. Let's explore how you can make the dream of your first home come true this festive season.

Understandin ... read more

7 Reasons Why People Hesitate to Refinance Their Mortgage

27th September 2023

Refinancing a mortgage can offer homeowners numerous benefits, from securing more favorable interest rates to decreasing your monthly outgoings. Yet, many homeowners hesitate to take this step. Here are seven common reasons why:

Lack Of Time: Refinancing a mortgage by yourself requires a signi ... read more

Clawbacks in the Media

20th April 2023

Over the last couple of weeks there have been some media reports about broker clawbacks and how these work, so let’s clear the air.

When a broker assists you with a loan, the broker gets paid an upfront commission by the lender. If you repay that loan before it has run for between 18 months and ... read more

6 Mistakes to avoid when refinancing in 2023

24th March 2023

With interest rates on the move, many people are shopping around for home loans. In January, the value of external refinancing for total housing fell 2.1%, but remained close to record highs at $18.6 billion. If you’re considering refinancing, it’s a good idea to be aware of a few pitfalls whe ... read more

8 tips to save and pay off your mortgage sooner

26th October 2022

It’s no secret that paying off your home loan sooner can save you plenty. However, with cost-of-living pressures and rising interest rates, it can be hard to find extra cash.

A series of small changes applied consistently over time could put you on track to reach your goal sooner. Here are 8 tips ... read more

Mortgage Broker "Best Interest Duty"

26th September 2022

If you read our blog from November 2019 we wrote about ASIC Regulatory Guide 273 “Broker Best Interest Duty” we thought that it was time for an update.

So, what is a broker’s best interest duty (or obligation). In simple terms it means that a broker has to place their client’s interest fi ... read more

Life with Rising Interest Rates

28th June 2022

Right now, more than ever before, you should be paying a little more each month off your home loan. Why, you ask? Many mortgage holders have never lived in a rising interest rate environment, so this is a new world for them. For many who fixed their rates in the last year or so, the shock of the new ... read more

How a mortgage broker gets paid and why

24th September 2021

In most cases a mortgage brokers client do not pay for their services. So how do we get paid? We are paid by the lender that we refer our clients to. We are most often paid 2 fees – an upfront fee and a second fee that is usually referred to as a trailing commission.

Before the Global Financial C ... read more

Is an Interest Rate Rise coming?

24th June 2021

It may be time to think about fixing your loan.

During 2020 (let’s call it ‘the covid year’) the Reserve Bank reduced rates to record low levels, and they are holding these, for now. During the Covid year we were all told that rates would be low and stay low for 4 or 5 year. But the upsid ... read more

Pssst; want to save some serious money?

28th September 2020

How long have you had your home loan? When was the last time that you checked the interest rate that you are being charged? Never thought about refinancing, heres’ why you should.A standard variable rate home loan is being charged 4.39% (comparison rate 4.49%). We have a 3 year fixed rate loan a ... read more

Looking to buy a home, but don’t have the full deposit - there are options

26th August 2020

Let’s face it, saving the deposit for a home can be hard when you are paying rent, and sometimes ‘life happens’. Can you achieve home ownership without the need for a full deposit? The short answer is yes, there are options – when buying a home there are 3 things that you need to bear in min ... read more

What is up (or down) with real estate?

26th May 2020

For years we have heard that the property bubble is about to pop, and while there have been some corrections it seems that the growth in value never seems to waver. With the onset of Covid-19 some analysts are predicting value declines of 10%, 20% or even 30%.

Against that what are we seeing? Re ... read more

Self-funded retiree and need some extra cash?

4th May 2020

We certainly live in challenging times. Covid-19 is impacting on our daily lives and many self-funded retirees are doing it tough. Interest rates are at an all time low, many companies announcing reduced or no dividends, rental income reduced or gone completely. And your eligibility for most of ... read more

Home Loan Types

15th January 2020

First Home Buyer Home Loan

Buying your first home is an exciting time. First home buyers are offered government concessions to assist you joining the home ownership ladder. Some lenders will also offer first home buyers’ further savings, so it pays to receive professional and sound advice.

Read ... read more

Coming soon the 'Best Interest' Test

27th November 2019

If you followed the Banking Royal Commission and the subsequent media reporting you will have heard about a new “Best Interest Duty” that is being introduced for the broking industry. Lets be clear on one thing though, for us what is in your best interest is also in our best interest as well; so ... read more

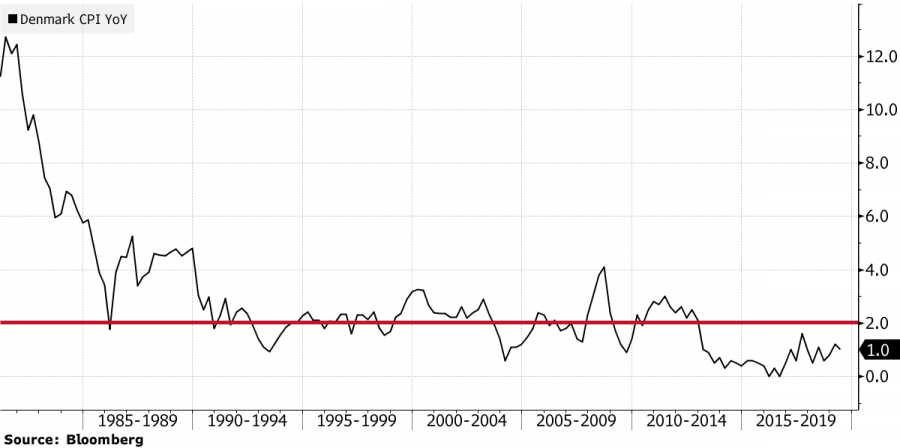

Negative interest rates

23rd August 2019

Banks paying off your home loan

Recently a Danish bank launched what is believed to be the first home loan with a negative interest rate – a 10 year fixed rate loan with a rate of minus 0.5% - yes this means that every month when you make your repayment the banks tips in a little more. But is thi ... read more

Life is about choice

25th June 2019

Every day we make choices. Get out of bed? Vegemite or peanut butter on toast? Go to work? Many of these choices are so simple that we make them automatically and they really don’t require that much thought.

Then we have the bigger choices – get married? Have children? Take 12 months off and ... read more

The Tail of the Lazy Mortgage

24th May 2019

(or in our world, “grandfathering”). How long have you had your home loan? 3 years? 5 years? Have you been caught by the ‘lazy mortgage’ trap? Let’s explain what this means. Think back to when you got your home loan, all the research that you did to get the best deal. Remember you picked ... read more

5 Tips to becoming financially savvy

29th April 2019

We all dream of being financially secure. It is not as hard as it may seem with these 5 tips below you can begin that journey

1. Living within your means is spending less than what you earn per week.

With easy access to credit cards, personal loans, ezipay etc it is proving more difficult for peop ... read more

If you saw $50 lying on the footpath would you pick it up?

20th March 2019

In the home loan world the equivalent is being able to get a better deal and not taking advantage of it. Say for example you initially took out a home loan over 30 years that had an initial discounted 2-year fixed rate, then reverts to the standard variable rate. At the end of the fixed rate perio ... read more

What are Comparison Rates?

5th December 2018

When you are researching home loans you will always see the lenders actual interest rate followed by what is called a ‘comparison rate’. Why is there a comparison rate? What is a comparison rate? And more importantly how does it help you?

Several years ago the federal government thought that it ... read more

To Fix Or Not To Fix

8th November 2018

With official cash rates on hold for just over 2 years, is now the time to fix your home loan interest rates?

It would be crystal ball gazing to suggest where interest rates are going. We will leave that up to the economists. Some of the trends we are seeing are:

Lenders making small adjustments ... read more

Have a great home loan experience while helping your local community

26th September 2018

Let’s face the reality, commercial banks are a business, and the more profit that they can make the better it is for them. Every home loan adds to that profit, and almost always means that the profit leaves our communities.

But, There is a Better Way. What if we told you that we have lenders t ... read more

Why Rent?

27th August 2018

Did you know that with current interest rates (based on an interest rate of 3.75%) each $100 per week in rent you pay may support a loan of about $95,000? So, if you’re paying $400 a week rent you may be able to support a loan of $380,000. If you think that you don’t have enough deposit chat to ... read more

Why should I use a broker? I can find a good deal myself

31st July 2018

There are lots of places on the internet that provide comparisons, you can troll the net yourself and visit lots of lender websites, or you can go old school and visit a branch of all your local lenders to ask questions.

The problem is that lenders have restrictions that are not always up there in ... read more

Is Lenders Mortgage Insurance the best investment you can make?

25th June 2018

There are several ways to borrow to buy a home – but the two most common are save the 20% deposit that most lenders require or buy Lenders Mortgage Insurance. There are other options, have a look at our other blogs to find out more.

Looking at the first option – saving the 20%. If you are on a ... read more

Planning to buy a property off the plan?

24th April 2018

An off the plan purchase takes place where a developer needs to pre-sell units in order to obtain finance for their development. Often you will find that these units are offered at a discount to the market initially in order to get those first sales completed. This can be very tempting, particularly ... read more

What’s up with interest rates? Is it time to lock them in?

31st July 2017

Recent market events and analyst talk appears to be pointing towards rate rises. What’s behind this?

Over the past few months lender regulators have been imposing more and more rules and restrictions on home loans, especially investor loans. The result has been that lenders are reviewing th ... read more

Changes to Investment Loans

6th July 2017

Important information regarding interest only investment property loans

We have seen over the last 2-3 months regular out of cycle interest rate increases on variable rate investment property loans where repayments are being made on an interest only basis.

These changes are being implemented large ... read more

Smashed Avo Is Not The Problem

18th May 2017

The poor old avocado is back on the hitlist of “millionaire” property owners, baby boomers and politicians. The apparent lack of ability of would-be homebuyers to give up their avocado, daily coffee or other little luxuries is somehow to blame for their inability to save money and get into prope ... read more

The IOA Loan and how it can help your tax position

5th May 2017

Disclaimer: The below information is generic in advice. Specific tax advice should be sought from your tax adviser with regard to your own situation and need.

The end of financial year is coming around again, and fast. For investors in both commercial and residential property, there is an opportuni ... read more

Does your Mortgage Professional stand out from the Crowd?

31st March 2017

We like the freedom to choose. It gives us control.

So imagine now if Nestle owned Woolworths. Do you think your choice to buy other brands in Woolworths might become limited? If you do, you may want to think about this next time you are looking for a mortgage professional.

With Banks owning most ... read more

How much can I borrow?

11th November 2016

This is a question that we get asked almost every day, and while the answer is often really simple, for others it is more complicated. There are two limits on how much you can borrow – how much have you saved, and how much you earn.

Savings

In an ideal world you would have saved a 20% deposit ... read more

Why Should I Refinance My Home Loan?

21st September 2016

Are you happy with your current interest rate?

Are you happy with the way the loan is structured?

Are you happy with the level of fees you are paying?

Are you happy with the relationship you have with your bank or lender?

If you have answered NO to any of these questions, then refina ... read more

How your home loan can improve your local community

4th September 2016

Support local business

Support the business that support your local clubs, sporting groups and charities

Invest your dollar locally and save money while doing it

Avoid the big banks and their drive towards unending profit

Be part of our revolution

How can you make a difference ... read more

Why brokers write more than half the home loans written in Australia?

26th August 2016

Well trained and experienced in lending

Do not charge consumers for their services

They are members of professional bodies that provide ongoing training, support and development

They are registered with ASIC and are subject to strict operating rules

They can access a range of ... read more

Qantas Frequent Flyer Home Loan

8th August 2016

Let your home loan take you around the world.

We have formed an alliance with a lender that allows us to provide Qantas frequent flyer points on your home loan. You can team that with the lenders credit card to boost your points quicker.

Contact us today to discuss your home loan to make sur ... read more

Commercial Property on the rise

16th May 2016

Have you ever considered taking on a commercial property investment? Or owning your own commercial premises. At least one major bank is predicting increased demand in this sector.

According to a report in the Australian Financial Review, a forecast from the Commonwealth Bank for 2016 predic ... read more

The Phantom

1st April 2016

Given my exciting online life of looking at lender websites all day, it seems that more and more, Facebook feels the need to display a lot of ads from a lot of different lenders.

Many of them attempt to attract your attention with a teaser interest rate but keep in mind that these rates can be misl ... read more

Negative Gearing on Negative Gearing

15th February 2016

Negative gearing has been getting a lot of press recently. Here at Regfin, we’re seeing both major political parties giving consideration to changes in property tax concessions.

Negative gearing allows a property investor to offset their costs of owning investment property against rental ... read more

Love the kids and want to help them into a home?

15th January 2016

To save for a home purchase can be extremely challenging, especially for young couples and families. Unfortunately, housing affordability continues to be a significant issue for many Australians with Coffs Harbour recently recognised as one of the least affordable cities in the world in which ... read more