Negative interest rates

Banks paying off your home loan

Recently a Danish bank launched what is believed to be the first home loan with a negative interest rate – a 10 year fixed rate loan with a rate of minus 0.5% - yes this means that every month when you make your repayment the banks tips in a little more. But is this a good thing?

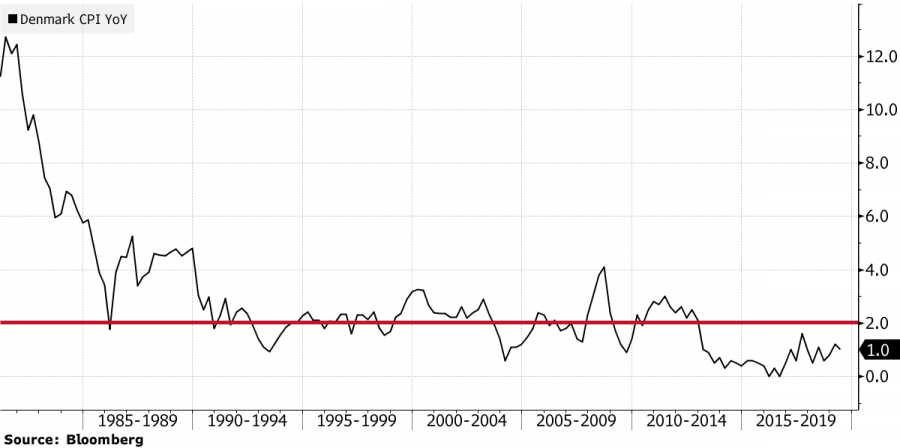

Interest rates have a link to inflation – high rates often mean high inflation, low rates often mean low inflation. So, what of a negative rate; does this equal deflation?

When we buy property we tend to think that it will go up in value and that over time inflation and wage rises means that your loan commitment takes up less of your disposable income. But with deflation we potentially see property values falling, real wages declining, and your loan commitment eating into more of your income. None of us want to see that.

Could this happen in Australia? While anything is possible we doubt it. Long term indications (out to 5 years anyway) are that rates may decline a little further, but tipping to negative seems a long bow. Remember that we are not economists, so this is only our thinking and looking for some discussion.

This leads us to talking about deals in the market place at the moment. Many lenders are pitching fixed rate deals in the high 2%’s so if you think that rates will stay where they are this may be a great time for you to lock your loan rates in. Even if rates do go down a little more these rates by historical comparison are pretty darn good and you can sleep comfortably.

Variable rates are also falling. The current lowest we have is 3.09% (comparison rate 3.12%) if you are eligible. Three months ago this lender was at 3.49% meaning that of the 2 x 0.25% reductions to the cash rate they have passed on 0.4%, pretty good when measured against the wider industry. Will we see a variable rate with a 2 at the front? Maybe, time will tell.

The thing is, we still see people that are loyal to their existing lender and have not challenged the rate that they are paying – what are they paying? Well into the 4’s and sometimes into the 5’s – so we will put this simple:

If you owe your lender $250,000 and are paying 4.96% against a possible 3.09% this is costing you nearly $390 per month. Read that slowly, you are costing yourself nearly $390 per month. To put another angle on it you could save enough money to buy a $20,000 car financed over 5 years. OK, so the cars not free, but the savings could pay for it.

The moral of the story? If you have a home loan and you are paying high 3%’s or higher get off your bottom and do something about it.

The usual small print – for any loan we need to ensure that the loan meets your financial needs and objectives. There may be fees and charges applicable. Loans are subject to an application being made and approved by a lender. Subject to eligibility. The comparison rate is based on a $150,000 loan over a term of 25 years, a different amount or term will provide a different comparison rate.

Contact Us to arrange a complimentary home loan health check today.